Survey of 25-44 year olds

Data provided by LV

Data provided by LV

This firm is committed to advising clients on better outcomes for the planet. As an example, 20% of funds that we advise on are alternative energy investments.

Our clients, with millions invested in clean energy, are making a real contribution.

Some other funds we support:

– Developing better engineering solutions, such as medical devices and prosthetic limbs.

– Technology that saves energy by stopping the cold escaping from freezer cabinets in supermarkets. Software solutions to manage risk.

– Financing childcare facilities, GP practices ambulances and better care homes.

Britain claims to be at the forefront of the fight against climate change and our scientists and engineers are trusted to provide solutions; your savings and pension pots can make a difference for your children and grandchildren.

Alternative Energy – facts.

The sector offers a range of funds to either provide capital growth, by investing in new developments, windfarms, solar, hydro, anaerobic digestion. Or income generated by buying into long term income contracts, usually 30 years.

Examples of Alternate Energy investments;

One provides money to build has returned 84.17% since its launch in June 2019

The other is an income fund gaining profit from long term energy contracts and returned 101,92% since December 2017.

NOTE: These are no guarantee of future returns

Coal and gas generation is increasing in cost

whilst solar is substantially cheaper.

The economic argument for solar is strong.

I offer this reminder, as I am often asked about the need to pay National Insurance and the most appropriate way to achieve full benefits. It is easy to check your personal account on line.

Clearly most of us do not rely on the State Pension and the question is how much additional funding is needed to achieve a realistic income at the time you plan to stop earning or reduce your working time.

Most people are shocked once they look at the levels of funding necessary, which means that you can either choose to fund to the desired outcome or delay your plans. Most importantly start early and fund realistically but also take the opportunity to get a realistic forecast.

Pension funding is still the most tax efficient way for all but basic rate tax payers, with Stocks and Shares ISAs used for anyone who is currently a basis rate tax payer.

One important warning, Cash ISAs give a return less than inflation and the only tax benefit is that the small amount of interest is tax free.

They do not make financial sense for medium and long-term savings. Inflation is expected to run at about 2.5% in the foreseeable future. Stocks and Shares ISAs are exposed to market fluctuations but rarely give a negative return in the longer term.

The most challenging issue for all 20 to 30 somethings is how to get on the housing ladder. As a country we consider home ownership an essential.

Tax policy is designed to drive behaviour and, as far as housing is concerned, it has worked for those who bought their homes at the right time.

For clients who have children and grandchildren it is a subject regularly referred to as a concern to them as well as the younger family members. Increasingly taxation is being designed to assist, one example of which is the Help to Buy ISA.

What is a Help-to-Buy ISA?

A Help-to-Buy ISA is a government scheme designed to help you save for a mortgage deposit to buy a home. To qualify you must be classified as a first-time buyer and not own a property anywhere in the world.

Savings are tax free just as with any ISA product. However, a Help-to-Buy ISA gives you the added bonus of getting government contributions.

How do Help-to-Buy ISAs work?

The government will top up any contributions you make by 25%, up to the contribution limit of £12,000. So, for every £200 you save, the government will contribute £50. This means you can earn a maximum of £3,000 from the government.

The minimum amount you need to save to qualify for a government bonus is £1,600 (which gives you a £400 bonus).

You can start off your ISA with an initial deposit of up to £1,000 which also qualifies for the 25% boost from the government.

Help to Buy ISAs are available to each first-time buyer, not each home. So, if you’re buying a property with your partner, for example, you’ll be able to get up to £6,000 towards your deposit.

Profile: Jan Oliff on tragedy that led her to ethical investments

By Amanda Newman Smith 5th November 2018

Jan Oliff on changing the sector’s gender profile and how personal factors led her to be an ethical specialist

Jan Oliff on changing the sector’s gender profile and how personal factors led her to be an ethical specialist

Sometimes the reasons people do the jobs they do or hold certain views are intensely personal.

That is the case with Jan, director, Jan Oliff Financial Planning.

Since establishing her own business in 1992, Jan has built a reputation as an ethical investment specialist.

Like many advisers in the field, Jan has generated business through a genuine interest in helping others and aiming to create a better world. But ask her why she became interested in socially responsible investment in the first place and it becomes clear it was for personal reasons rather than business ones.

“My mother died in 1986 at a young age.

Nobody had told her smoking was dangerous and she had lung cancer. I wanted to invest some money that she had left me into something that avoided tobacco. Only the Stewardship fund offered that at the time, so I invested in it and that was my way into the SRI* marketplace,” she says.

Jan believes the SRI* market has gained many supporters as a result of the 2008 financial crisis.

How to get started with ethical investing

“Clients felt let down by financial services around the time of the crisis and people are becoming increasingly aware of issues such as damage to the environment.

“Everyone has their own story and their own values based on personal experience. Some are more interested in governance issues than the environment and vice-versa,” she says. “I have one client who is in her 80s and she wouldn’t invest in gambling because, as a young teacher in Glasgow, she was seeing children coming to school with no shoes on because daddy had spent all the money in the betting shop.”

Five questions

What is the best bit of advice you’ve received in your career?

Don’t retire. It came from my 92-year-old neighbour, a district nurse who retired at 72 and thought it was far too soon.

What keeps you awake at night?

Nothing to do with work. If it was, I’d give it up.

What has had the most significant impact on financial advice in the last year?

Increasing awareness of values and governance.

If I was in charge of the Financial Conduct Authority for a day I would …

Listen to a representative sample of workers as the go-to people for ideas to improve the system and culture.

Any advice for new advisers?

Use your brain and your emotional intellect. Together they are powerful.

Jan was drawn to the financial services world following some tragic personal events that really brought home to her the need for people to plan their finances.

Her sister was widowed at the age of 29 and she sadly lost a friend in a car crash. At the time, her friend had everything to live for; he and his wife had just had a baby and were in the middle of renovating their home. “His wife had to return home to her parents because they had no life insurance,” says Jan .

Wanting to get the message across to people that it was important to be financially resilient, just in case the worst happened, Jan joined Barclays Life in 1981 and stayed there for 11 years. However, by 1992 she had become disillusioned and it was then she decided to set up her own financial advice firm.

“It had become clear that banks were giving priority to selling contracts that made money for them. I left Barclays early in 1992, at a time when the country was in deep recession and jobs were scarce. I’d relocated to Bristol, I had just got married and everything combined to say it would be better to create something,” she says.

So what has it been like for her to do that as a woman in financial services?

“It’s been largely amusing and sometimes frustrating. At times, my physical appearance is the only thing that seems to matter,” she says.

“My frustration comes in at the lack of understanding about the insight and intellect that women can bring to the industry. As head of the International Monetary Fund, Christine Lagarde recently said if it had been Lehman Sisters rather than Lehman Brothers, we would have avoided the crash. I’m not going to argue with that.”

Jan thinks getting more women into the industry will happen naturally, once men with old-style, sexist attitudes have left.

“The industry will get rid of the wrong type of bloke and more women will come in once they’re gone. Things are a lot better now, but the bad attitudes are still there. Even women have that bad attitude at times. The whole culture in financial services has been one of bullying and disrespect. You have to stand up to it,” she says.

For some women, perhaps the misconception that financial advice is all about facts and figures rather than building relationships and finding solutions to problems puts them off it as a career choice. Jan points out the fact many advisers rely on their para-planners for the more technical side of the job.

“The para-planners are the ones doing the numbers; they do most of the technical stuff. Take a lot of IFAs away from their para-planners and they’d be lost.”

Trust and transparency are things Jan works hard at in relation to her clients. She is a member of Soroptimist International, a global volunteer organisation that has more than 75,000 members in 120 countries. With human rights and gender equality at its heart, the aim is to make women’s voices heard and help fund local causes.

However, Jan believes any sort of volunteering – whether it is charitable work or providing pro bono advice – should be for the right reasons and not to promote a professional service. Her thoughts on creating more widespread consumer trust in advisers are as simple as starting with the way you treat your colleagues and clients.

Should financial advisers be volunteers?

“I truly believe if every practice has a culture of respect for clients and colleagues, so it becomes unacceptable to say abusive or unkind things, if you do that, you gain trust,” she says.

“We are moving forward, as there are many good advisers who are great for the profession. But we need to get rid of the ugly ones as they cost the rest of us a lot in terms of our reputation and the Financial Services Compensation Scheme levies. I’m still confronted by people at conferences that make me think ‘what on earth are you still doing in this profession?’.

“Every profession has this, but I wonder why we tolerate it. We need to encourage those individuals to get out and earn their income elsewhere.”

.

* SRI – Sustainable Responsible Investing

Read moreGovernment report shedding new light on social impact investing

What is the most satisfying outcome and at the same time the most challenging to deal with? It’s the late night call from a family whose main wage earner has been injured or taken ill, worried about paying the bills.

What is the most satisfying outcome and at the same time the most challenging to deal with? It’s the late night call from a family whose main wage earner has been injured or taken ill, worried about paying the bills.

Self-employment is now increasing and with it the amount of families who are made vulnerable due to the lack of protection. Being able to tell the family that the income protection or the life assurance are in place can at least stop them worrying about losing their home.

The last thing anyone with a major health condition needs is to worry about debt.

I became a financial services professional motivated by a need to do something to change outcomes for people. Having experienced, at close hand, what happens when the protection is not in place.

My profession gets more complex by the addition of pension freedoms, ISAs and General Investment Portfolios but at the core it’s about making certain that money is in the hands of the right people when it’s needed.

Over the years I have dealt with claims for Critical Illness and Income Protection.

I do not remember anyone saying that it was too much. On the contrary the majority say I wish I had more. The job of a good adviser is to ensure it’s sufficient and that the premiums are affordable.

Interestingly, very few people can tell me how long they get paid when off work sick, yet they usually know how much holiday they are entitled to. Yet to protect those holidays for the future, you need an income.

One of the Income Protection providers we use is The Exeter and I would like to share one of their claim stories.

Please read it, and once you have, pass this on to someone you care about : Adams Claim Story – 2017-2420

If you are an employer, could this apply to you?

Founder, sriServices & Fund EcoMarket

Ros Altmann* writes in Money Marketing

“I want to highlight a major pensions injustice concerning employers who choose an auto-enrolment scheme administered on a net pay basis.

“Such schemes cannot add the 25 per cent bonus of tax relief to contributions of workers earning less than £11,500 a year from the employer.

“Auto-enrolling these employees – mostly women – into a net pay scheme forces them to pay extra for their pension. Every £10 that someone on more than £11,510 a year puts into a pension will cost only £8 but every £10 low earners contribute costs them the full amount. So the lowest paid are paying £2 more for the same pension.

“If their employer were to use a relief at source scheme instead, no one would have to pay more than £8 for their £10 of pension. But most would not understand the difference between choosing a net pay or relief at source scheme.

When discovering this as pensions minister, I tried desperately to address it. But nobody was interested in helping the low earners.Officials said “It’s not much money”, which I found unacceptable.

Firstly, it may not be much money, but it could and should be theirs if their employer had chosen a different scheme.

Ever Present Danger

I once asked a friend if the widow of his next door neighbour would receive a life assurance payment.

I once asked a friend if the widow of his next door neighbour would receive a life assurance payment.

He, my friend Ernie, was a bit shocked at the question. It is not something you generally ask the recently bereaved.

It is however something the family care about.

Will we be able to pay the bills this month, this year, in the future?

I know it sounds a tad un-British to ask about money at such a time but here is what I know. Death or major illnesses intervene when not expected. Having a safety net can make a difference in how you recover from the loss of a loved one or the shock of sickness or injury.

If your busy life has contributed to a heart attack then money at the right time can pay the bills, stopping much of the stress. It can give time for recovery.

In my 35-years career, I have experienced late night calls from worried clients asking “will I be able to pay the mortgage this month. Will I need to sell my home?”

Sickness and death are not just for the elderly but they are an ever-present danger. Most of us, mercifully, will never be harmed at the hands of a terrorist but never the less life rarely treats us kindly.

ISA

I return to the subject of ISAs.

Why? Because I am still hearing people complain about the low interest they are getting on cash ISAs. Apart from it being frustrating to overhear this, it occurred to me that people have stopped listening to advice.

Cash ISAs lose money, as inflation is higher than the annual interest rate, FACT

As an independent adviser, each client is different and gets treated differently.

But if you want a simple, do it yourself solution, check out some of the on-line offerings, watching out for charges and historic volatility: Both Prudential and Royal London have funds that are designed to minimise risk.

![]() If you want an opportunity to do good as well as making a better return then find an Ethical or Socially Responsible Solution: www.uksif.co.uk

If you want an opportunity to do good as well as making a better return then find an Ethical or Socially Responsible Solution: www.uksif.co.uk

And if you would prefer to accept and pay for valuable good professional advice . . .

Paid for Advice?

Why pay for advice when you can find insurance cover and/or ISAs on line? Whether you pay for the advice or pay for the product, you still pay.

Why pay for advice when you can find insurance cover and/or ISAs on line? Whether you pay for the advice or pay for the product, you still pay.

The advice is there, as an option.

To discover the full range of available solutions, you will need independent advice.

Is price the only thing that matters? When it comes to your family probably not.

Climate Change

As the world fails to act water will become a weapon and a cause of war.

As the world fails to act water will become a weapon and a cause of war.

Regimes that control water will hold a powerful weapon. You can ensure that the world harvests, recovers and maintains its quality, by investing in commercial businesses whose products do just that.

The Women’s Institute is having a week of action on Climate Change in July.

Please support them.

Internet of Things to reconfigure business, consumer and investment landscape

Internet of Things to reconfigure business, consumer and investment landscape

Reproduced by courtesy Pictet Asset Management

This is interesting but does not constitute advice.

If you are interested in sustainable or less ‘traditional’ investment please talk to Jan.

Eleven inches tall with shiny blonde hair, the iconic American doll Barbie made its debut at the New York Toy Fair in March 1959.

Just over half a century later in 2015, the same toy fair unveiled a new prototype of Barbie. And this version could not be more different from the original.

Called ‘Hello Barbie’, the wi-fi-enabled doll uses artificial intelligence to connect to a cloud server, which allows children to interact with her through a microphone and speaker built into her necklace.

Hello Barbie is just one manifestation of the burgeoning world of the Internet of Things (IoT), a platform of interconnected devices and machines built on cloud computing and network sensors.

The IoT is becoming a bigger part of our daily lives – we now have smart fridge that ping us when we’re low on milk, wearable devices that offer personal health and fitness advice and connected cars which shares traffic information with other vehicles.

In the not too distant future, smart energy or water meters powered by IoT sensors will send real-time information to providers which can better manage their production or distribution network; retailers can adjust their warehouse inventories based on round-the-clock demand data coming from IoT devices.

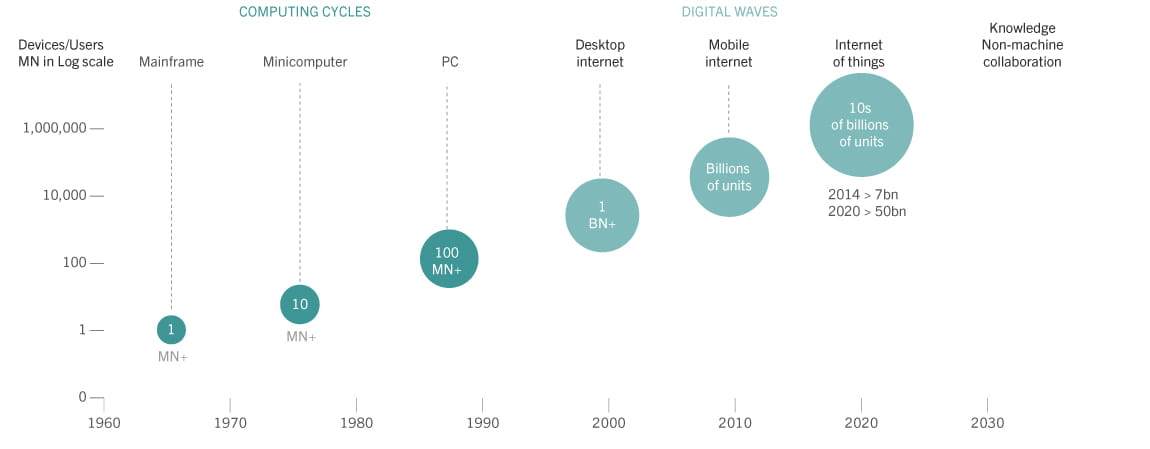

But this is only the beginning of the IoT revolution: the number of connected “things” could reach 50 billion by 2020 while the IoT market is expected to double to USD3.7 trillion by the end of this decade.1

“This is an incredible opportunity for all of us and something we should take very seriously. And frankly the question you’ve got to ask is: ‘is there anything in the world that won’t be touched by the Internet of Things?’” says Sanjay Sarma, professor at the MIT and one of the world’s leading experts on the IoT.2

“Is there anything in the world that won’t be touched by the Internet of Things?” – Sanjay Sarma

The IoT will change the rules of the game; enterprises are already under pressure to abandon old business models and adopt a new approach.

And as companies are disrupted, new investment opportunities should emerge.

“Every time there has been a new class of computing, the total revenue for that class was larger than the previous ones. If that trend holds, it means the Internet of Things will be bigger yet again,” observes University of Michigan professor David Blaauw.3

Source: Morgan Stanley, April 2014

From living rooms to assembly lines

The IoT began life as smart home technology in the shape of AI-powered, voice-activated personal assistants such as Amazon’s Echo and Google Home.4

Today, however, it is expanding into factories, where a new generation of smart industrial robots now perform repetitive, strenuous and increasingly complex tasks without the need for human intervention. What is more, these connected robots communicate with each other in what is known as machine-to-machine (M2M) communication.

For example, Japanese robot maker Fanuc has developed technology that connects the brains of more than 400,000 of its industrial robots so that they can learn from each other and improve performance on manufacturing lines.

In working with Cisco, US factory automation systems maker Rockwell Automation and Preferred Networks, a Tokyo-based machine learning start-up, Fanuc says its M2M network will improve equipment efficiency and increase manufacturing profitability.

Fanuc is not alone – its German rival Kuka is working with Chinese telecoms company Huawei to link up its industrial robots in much the same way.5

An industrial-scale version of the IoT is certain to reconfigure manufacturing, ushering in what experts are calling the next Industrial Revolution, or Industry 4.0.

The first industrial revolution, which began in Britain in the mid-18th century, took about 100 years to spread as the use of machines gradually replaced human labour in Europe. Industry 4.0 should evolve at a pace faster than any of the previous breakthroughs.

Accenture estimates that Industry 4.0 could add at least USD14 trillion to the world economy by 2030, while PWC expects more than USD900 billion will be invested in technologies and businesses related to Industry 4.0 every year until 2020. More than half of the world’s major firms surveyed by the consultant expected a return on investment within two years.

Industry 4.0 and M2M networks are beginning to transform manufacturers’ strategic priorities. Germany’s Audi plans to develop a “smart factory” which makes cars with robots working together with human colleagues, 3D printers that print complex metal parts and drones carrying steering wheels. Audi has even piloted cars driving themselves off the production line.

“Automobile production as we know it today will no longer exist in the future,” Hubert Waltl, member of Audi’s Board of Management for Production, told the automaker’s magazine. “It will become more connected, more intelligent and more efficient… New specialists such as network architects will increasingly move into our industry.”

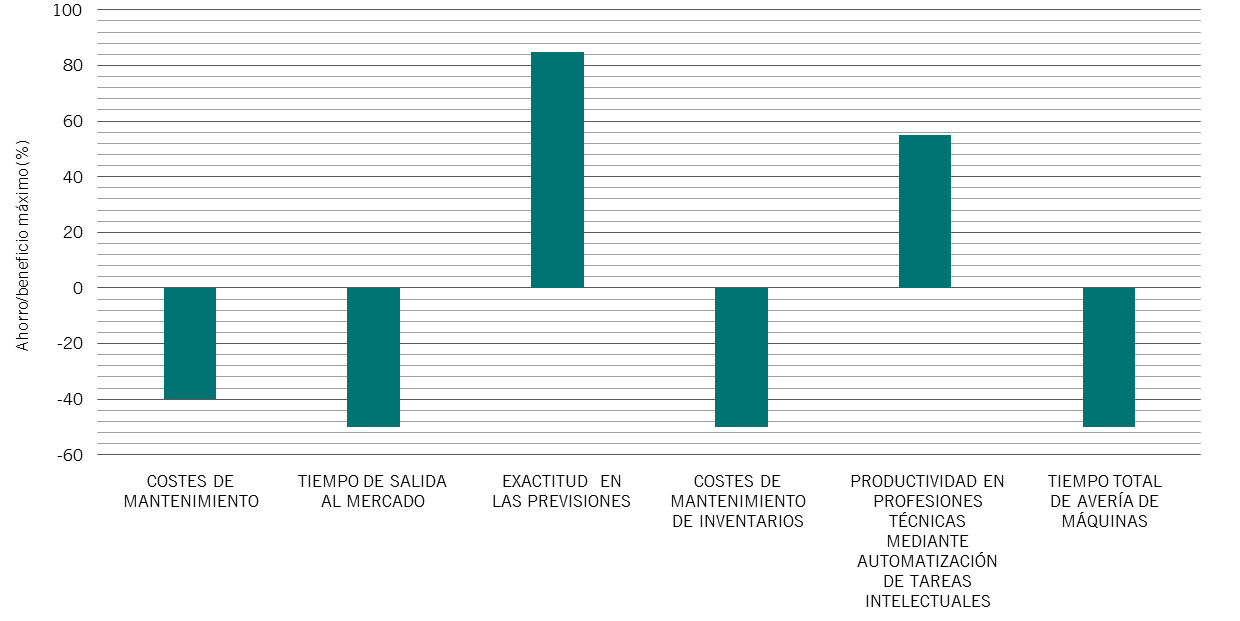

Like Audi, manufacturers will no doubt reap the benefits of Industry 4.0; costs for inventory holding are likely to fall by up to 50 per cent thanks to the real-time warehouse management enabled by IoT devices while total machine downtime will also halve as factories use machines more efficiently thanks to information coming from IoT sensors, McKinsey expects. Several other studies have shown the IoT will boost manufacturing productivity by as much as 50 per cent.

But it won’t be just manufacturers; consumers and investors are set to enjoy the perks; Industry 4.0 will not only drive production costs down but also allow factories to produce goods which better reflect the trend and preferences of consumers.

This means we will be able to buy highly-customised IoT objects at cheap prices. The more people that use a given IoT object, the greater its network effect, a mechanism that rapidly magnifies the value of the object to each of its users.

Platforms have completely changed the nature of competition across many industries.

Companies like Apple, Uber and Amazon are already exploiting the network effect by building a complex web of interactions between consumers, suppliers, entrepreneurs and developers on “platforms”, digital marketplaces through which businesses offer a range of goods and services to consumers.

The platform economy built on IoT devices is beginning to disrupt the functioning of marketplaces and transform the investment landscape.

“Platforms have completely changed the nature of competition across many industries,” Austan Goolsbee, professor of the University of Chicago Booth School of Business, told a recent conference organised by Pictet Asset Management.

“(Successful investing) is not really about figuring out what is the most exciting technology… it’s also about asking ‘could that thing be a platform that prevents the next guy from coming into the market?’”

When I talk about ethical and sustainable investing what does that mean? Sometimes that depends upon the client who may have special preferences.

When I talk about ethical and sustainable investing what does that mean? Sometimes that depends upon the client who may have special preferences.

For me it can mean a wide variety of options and opportunities and, to the surprise of many, it also means serious investment.

![]() This article, kindly provided by Pictet Asset Management gives the story of water investment. You can see this as purely an investment opportunity, as an opportunity to use your investment monies for a better world; or you can also see the human and social benefits.

This article, kindly provided by Pictet Asset Management gives the story of water investment. You can see this as purely an investment opportunity, as an opportunity to use your investment monies for a better world; or you can also see the human and social benefits.

This is also an invitation to think more creatively about how you invest and to do that all you need to do is talk to Jan.

This is what Pictet is involved in . . . . .

The private water supply sector consists of companies serving the population through the supply and storage of drinking water.

By 2050, up to 4 billion people across the world could be living under ‘severe’ water stress, up from 1.2 billion today.

Economic growth is exacerbating the water shortage as it boosts personal wealth, leading to increased consumption of products that require more water to produce, such as animal protein.

For example, producing a kilogram of beef requires 15,000 litres of water, six times more than is needed to produce the same amount of rice.

—

Governments are increasingly unable to maintain supply due to tight budgets and ageing infrastructure.

This means that private companies will play an ever-more important role throughout the human water cycle, especially in North America and Central & Eastern Europe, where they are expected to increase their market share by more than 10 per cent between 2013 and 20253.

With other regions, such as South America and Asia, requiring up to USD 14 trillion of investment by 2030 to secure their water supply, there will be countless opportunities for companies involved in innovative water supply solutions, such as water recycling and desalination, to profit.

Water treatment

The water technology sector consists of companies developing the tools and systems to improve the efficiency with which we use water.

For instance, as much as 75 per cent of the world’s available freshwater supply is unsafe for consumption due to contamination or pollution.

Governments can enact measures to safeguard water sources from pollutants, but it is private companies involved in the development of innovative filtration systems, such as permeable membranes or UV filtration, that will provide solutions to these issues.

Leakages

In developing countries, more than 45 million cubic metres of water are lost through leaks every day. The cost of improving existing public infrastructure globally is predicted to exceed USD20 trillion between 2005 and 20304.

Companies producing innovative water technology solutions, such as next-generation sensors and monitoring equipment that can increase the efficiency of water usage and help avoid wastage through leaks, represent compelling investment opportunities.

Irrigation

With 70 per cent of the world’s available freshwater used to support agricultural production, governments are now tackling the wasteful use of water in this sector, such as through the fines California has imposed on those who irrigate their crops in daylight hours during droughts.

This focus on waste is creating opportunities for companies making advances in agricultural water technology, such as drip irrigation, which only intermittently wets the soil that is closest to the crop, and thus provides higher moisture levels while using less water.

Waste management

There is growing awareness, especially within developing countries, about the need to deal with the water supply problems arising from improper solid waste disposal, which in China has led to nearly 60 per cent of the country’s underground water and a third of its surface water being classed as ‘unfit for human contact’.

The Chinese government is determined to improve this situation, with its 2015 ‘Water Ten Plan’ putting in place tough targets on polluting industries to provide ecological and environmental protection. With industrial wastewater treatment in China reaching around 90 per cent penetration, the focus will shift to tackling the rise of domestic waste output.

Companies operating in the environmental services sector and providing solutions to waste water collection and its treatment are predicted to benefit.

![]() Government announces significant overhaul of probate fees from 1 May 2017

Government announces significant overhaul of probate fees from 1 May 2017

Last February, the Government began a consultation into probate fees and how much families should be charged for extracting the Grant of Probate.

Their proposals outlined a move away from the current application fee of £215 for an individual and £155 for professional, to a new tiered fee system based on the value of the estate in question:

We introduce clients to King’s Court where the clients show interest.

You can read about working with King’s Court (KC) here

![]() Kings Court Trust was one of 853 firms or individuals to formally respond to the consultation.

Kings Court Trust was one of 853 firms or individuals to formally respond to the consultation.

They voiced strong opposition to the plans, citing the fact that the proposed fees would potentially cause significant financial difficulties for families already having to deal with the loss of a loved one. Despite overwhelming opposition, the Government has approved the changes to the fee structure and these will come into action from 1 May 2017.

What does this mean for clients that use King’s Court

through Jan Oliff Financial Planning?

Our clients will have the fee changes clearly explained to them.

KC is committed to supporting any families who need advice and support on what the fee structure change will mean for them and are currently investigating a number of options that will allow us to help families manage the additional cost of the Grant of Probate as a result of the new structure.

How will this impact on Kings Court Trust’s fixed fee service?

KC’s comprehensive estate administration service will still be offered with a guaranteed fixed price.

They have removed the cost of the Grant of Probate as a fixed charge and will not be reintroducing this until there is a clear understanding of the new processes that the Probate Registry will be putting in place.

Instead, KC will explain clearly how the new fee structure will impact on the estate in question so that clients have as much information as possible.

This is from the PFS – Professional Finance Society – my professional body.

The proliferation of investment and pension scams have been a growing concern over the last few years, but since the introduction of pension freedoms unregulated activity has multiplied leaving consumers vulnerable to ever more sophisticated scams.

During 2015/16 more than 3,000 people reported being caught up in scams with an average loss of £32,000. As most scam losses go unreported the actual numbers will be much higher. It is clearly time to take further action and as a profession we have a vested interest in contributing to the wider effort of helping protect consumers.

The 15 minute commitment

I announced at our London Financial Planning Symposium in November that we had joined forces with the FCA in an effort to help protect growing numbers of consumers. Members have been asked to help raise awareness of scams amongst their clients and professional networks. But for personal finance professionals, scams and unregulated investment schemes with overblown promises are easier and quicker to spot than unsuspecting members of the public. We therefore need to mobilise as a united profession to help the authorities by sniffing out and reporting suspicious investments and potential scams.

The small commitment we are asking Personal Finance Society members to make is to spend just 15 minutes per month to help identify and report potential scams. As a profession we have the opportunity to make a huge impact in smoking out and helping close down investment scams before they do too much damage.

Visit the PFS website where there are ideas on how to spend 15 minutes. The website contains information and case study videos along with an overview of the tactics used by scammers. There is also a link to the FCA’s ScamSmart microsite where you can find the latest warning list and details of how you can report a potential scam.

Contact me about this if you wish

It’s not just inexperienced investors who are falling victim to scams; savvy investors are falling victim too and are the target for more sophisticated scams. Affluent retirees aged over 60 are now most likely to be victims.

Just a quarter of people seek the advice of a professional adviser prior to committing to an investment and one in eight people spend little or no time researching investment products before handing over the money. It’s time our profession played its part in demonstrating the value of professional advice and helping protect consumers from the unscrupulous.